Despite the recent COVID-19 pandemic, the Canadian real estate market has continued to grow. Many individuals are continuing to buy and sell homes and invest in residential rental properties. As part of that process many buyers are taking advantage of the record low interest rates and applying for mortgages. This can be a complex and tedious process. Luckily there a few things you can do ahead of time to prepare for a mortgage application and make getting approved hassle free!

Photo by Precondo CA on Unsplash

1. Make A Detailed Budget Before Applying for Anything

Whether you are an investor or just a regular home buyer, you should always put together a detailed budget before you start seriously shopping for your next (or first) property. The mortgage application process can be made much easier with a bit of preparation. It is important to understand how much of your regular monthly income you can afford to devote to housing costs. It is easy to get caught up in the excitement of purchasing your dream home and make yourself “house poor” by buying a property at the upper end of your budget. This is especially important if you are an investor, as the lender will use a most likely use worst case scenario where you earn no income from the new property in order to qualify you for the new mortgage loan.

There are many different free online mortgage calculators available that make it easy to calculate your monthly debt payments in various scenarios. They are an excellent planning and budgeting tool. Some of the better quality ones will also give you a snapshot of advertised mortgage rates and integrate with more sophisticated retirement planning software.

Don’t forget to include an estimate of your closing costs (all the misc. fees that come with buying real estate) in your budget. Underwriters will estimate your closing costs when reviewing your loan application and credit reports. It’s important to consider whether or not you will draw on any savings you may have in investment accounts like an RRSP or TFSA. If so you will need to make a plan to sell some stocks, mutual funds, bonds etc. many people wrongfully assume that mortgage funds can only come from their savings and chequing accounts. Some investors choose to preserve their cash reserves and instead draw upon different types of credit, via a bank loan, line of credit or even certain credit cards that offer zero or very low interest balance transfers. The latter is a strategy that is best left to the pros!

The general rule of thumb recommended by many financial advisors is to limit your housing expenses to 30% or less of your total income. I realize this is almost impossible for the average person in expensive markets like Toronto or Vancouver but try to get as close to that benchmark as possible. When evaluating income properties or flips it’s best to calculate ahead of time how much you can spend before hitting your maximum allowable total debt service ratio and how the new real estate income will affect this ratio. A mortgage broker or certified financial planner can help you with these calculations.

2. Check Your Credit Score

Before applying for a mortgage, be sure to check your credit score at either TransUnion or Equifax. Lenders will be checking your credit score, so you’ll want to review it in advance to see if there are any reporting errors or outstanding debts you were not aware of. It’s surprising how often false late payments are mistakenly reported by some credit card companies. You should ask the credit bureau to correct any reporting errors and ensure that you discharge any debts in arrears/collections. This will improve your credit score and help you raise the total loan amount you qualify for. It is best to do this before beginning the pre-approval process as the inevitable “hard checks” on your credit will temporarily lower your credit score.

Generally speaking, if your score is 760 or higher, you’re going to get the best rate on the market at the time. To qualify for an insured, CMHC backed mortgage, at least one borrower will need a credit score of 680 or higher. It possible for those with credit scores in the 600’s to get loans but it’s more difficult and the interest rates charged will be higher.

3. Gather and Organize All Your Financial Documents Ahead of Time

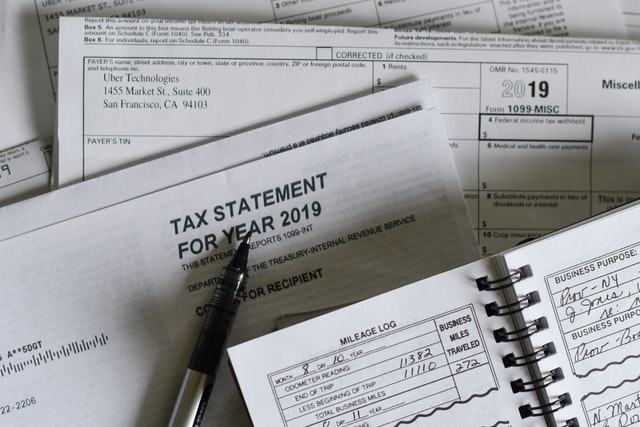

Whether you choose to work directly with a bank or with a mortgage broker, they will need to examine your financial records in detail before approving you for any loans. This means they will need to see copies of all your bank records, tax documents, investment portfolios, lists of assets and debts etc. The underwriter will need to see a paper trail that shows where all of your down payment funds have come from. If your funds have not been in your bank account for at least 30 days prior, it will trigger additional scrutiny.

This task can be extremely tedious and boring, but it can’t be avoided. It’s best to deal with this before you start searching for a house. Buying real estate is already a hectic and paperwork intensive process. If you gather and organize all of your financial records ahead of time your mortgage broker will thank you and the mortgage approval process will be much smoother. You will also free up your time and energy to focus on the details of the deal and actual property, rather than having to stress about tracking down some obscure bank document.

4. Carefully Consider your Down Payment Options

If you can afford to pay a down payment of 20% or more, it’s generally advisable to do so. In Canada you can get mortgages with as little as 5% down, if the house will be your primary residence. However, you will be required to pay for mortgage default insurance if you put less than 20% down and this can add tens of thousands of dollars to the overall cost of purchasing a house or apartment. For many younger buyers, the comparable cost of renting and/or the opportunity cost of not being in the real estate market at all will make the added costs of mortgage insurance worth it. You can also plan on reducing your debt more quickly by using a mortgage with an accelerated payment schedule (ex. bi-weekly) or shorter amortization.

Many buyers will actually be eligible for lower interest rates on their mortgage if they make a down payment of less than 20%, rather than 20%+. This is because the lender must cover the costs of mortgage default insurance if the down payment or equity already in the home is greater than 20%. Lenders usually make up for this additional cost by charging higher interest rates.

5. Organize Your Tax Forms

Don’t try to apply for a mortgage if your taxes aren’t up to date. Underwriters often want to see at least three years of tax records to verify your income and employment status. They are checking to see that your can be relied upon to pay your bills on time and have not overstated your income level on your application. If you have a large outstanding tax debt it will hurt your ability to qualify for a mortgage. At best they will deduct the amount you owe from your available funds when calculating your total debt service ratio. More likely they will simply deny your application until you can provide proof that you have paid your taxes in full.

Creating an online “My CRA” account makes gathering and organizing all of your tax records relatively painless. Depending on your relationship with your mortgage broker you may find it easiest to just give them access to your online CRA account so they can access the electronic copies of your tax documents whenever they need them.

6. Research the Different Types of Mortgages Available

Depending on your financial profile and what you intend to do with the property, you may find another mortgage type/product such as a variable-rate, or a purchase plus improvements mortgage to be better suited to your needs. If you are planning on owning the property for less than 2 years or buying a fixer-upper these type of mortgage products will offer a lot of advantages. Do some basic research about the different types of mortgages and familiarize yourself with the general concepts and terminology. This will save time when you meet with your mortgage broker and help ensure that you are asking them the right questions.

7. Think About Life Insurance

Your mortgage(s) will likely be the largest and most serious debt you ever take on in your lifetime. It may seem strange to think about, but it’s important to have a plan in place for what will happen if you die unexpectedly before paying back the loan. Whoever inherits your estate or house could be left with an enormous financial burden if you don’t have an insurance policy large enough to cover all of your debts and obligations. Most mortgage brokers and/or major lenders will try to sell you a term life insurance and/or mortgage insurance policy when you get a mortgage through them. While this may be adequate you will likely not get the best deal possible. It’s usually best to meet with an insurance broker to explore your options for life insurance and get quotes well before finalizing mortgage contract. An insurance broker will be able to better advise you regarding your available choices and may offer a more competitive rate.

Connect with Dwell Logic

Consulting meetings are available via telephone, video conference (Google Meet or Zoom) or in person.

Get in touch with us to book a consultation.