For many Canadians, when we think mortgages, we tend to think of only one type of mortgage: a fixed-rate mortgage, usually on a 4 or 5 year term. Often banks will refer to these as “conventional mortgages”. However, there are many other mortgage options to consider and each one has different pros and cons! Below are the pros and cons of the most common different types of Canadian mortgages. For advice on how to prepare for a mortgage application check out last weeks’ article. For the most part there are three main variables that can be altered to create different mortgage products. They are amortization (i.e. how long it will take to completely pay off the mortgage), whether the interest rate is variable or fixed and if there are any special conditions added to the contract like cash back or purchase plus improvements. By combining these variables lenders create most of the mortgage options available to the average buyer.

Fixed Rates

This one is pretty self-explanatory. The interest rate is locked in for the term of the contract. In Canada, the term can vary from 6 months to 10 years. With private mortgage lenders it’s possible to go longer or shorter than this. Pros

- The biggest advantage for a fixed-rate mortgage is the security and peace of mind that a fixed rate brings.

- Fixed rate loans makes budgeting relatively easy.

- Fixed rate property loans are easy to understand. Conventional fixed rate mortgages are the bread and butter of the residential market.

- If the prime interest rate and/or prevailing market rates increase you will be able to continue with your now lower rate.

Cons

- If the prime interest rate and/or prevailing market rates decrease you will not be stuck with your now non-competitive interest rate.

- If you need to break or discharge (i.e. sell or refinance the property) the mortgage before the contract term expires, then you will be charged penalty fees. The penalty is used calculated using the “interest rate differential” or a minimum of 3 months interest, whichever is greater. This can add thousands of dollars to the total cost of your mortgage loan.

Variable Rates

The name says it all. The interest rate charged can vary over the course of the term. Typically the rate is tied to the prime interest rate of the bank in question or the Bank of Canada’s prime interest rate. These rates often go up or down throughout the year depending on economic conditions and the policy decisions of governments and/or nation banks. This type of mortgage is sometimes advertised as an “adjustable rate mortgage”.

Pros

- Standard variable rate mortgages usually offer lower interest rates than contemporary fixed rate contracts.

- It’s possible to find variable mortgages that offer a sizable discount on the prime interest rate. This is why these products are sometimes advertised as a”discount mortgage”. To qualify for the largest possible discount you will need to have a credit score of 760 or higher.

- If the prime interest rate drops you will be able to automatically take advantage of the new lower interest rate.

- You can usually convert the contract to a fixed rate mortgage for little to no fees/penalties. This can be useful if economic conditions change and you expect mortgage rates to rise in the near future. It gives you the ability to lock in a lower monthly payment when an increase to the prime lending rates is on the horizon.

Cons

- If the prime interest rate rises than your mortgage payments will automatically increase.

- You (or your mortgage broker) will need to keep an eye on general economic conditions and the predicted impact on interest rates. If you don’t, you could fail to convert to a fixed rate before a large increase in the prime rate, resulting in higher payments and more interest charged overall.

- Harder to budget for because the rate and associated payment size will fluctuate.

Mortgage Amortization

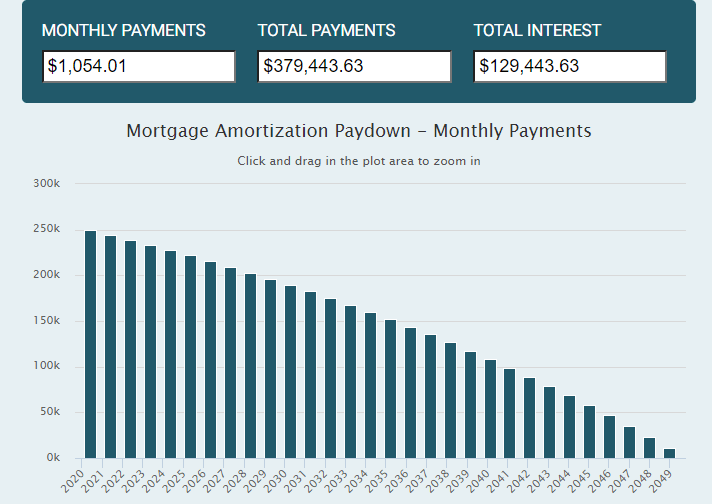

The amortization of a mortgage refers to the amount of time allotted to completely repay the loan. This is often confused with the mortgage term. The term is just the portion of the loan’s total lifetime covered by the mortgage contract/product in question. Mortgages are usually structured to have amortizations that increase or decrease in 5 year increments, but this is not a hard and fast rule. Each regular mortgage payment will consist of two portions. The first goes towards repaying the principal amount borrowed and the second goes towards servicing the interest charges. At the start of the amortization period the ratio will be skewed in favour of the interest charges. With each payment made the ratio will slowly adjust to favour the principal portion instead. See the 30 year amortization graph below for an example of a typical mortgage repayment scenario with no prepayments or early discharge. Let’s use a mortgage with a loan amount of $250,000, and an interest rate of 3% for our example. The most commonly seen mortgage amortizations in the Canadian real estate market are 15, 25 and 30 years. We will use 30 and 15 year mortgage amortizations scenarios for the example below.

30 Year Mortgage

Calculations performed using the mortgage calculator at https://www.mortgagecalculator.net/cad/

Calculations performed using the mortgage calculator at https://www.mortgagecalculator.net/cad/

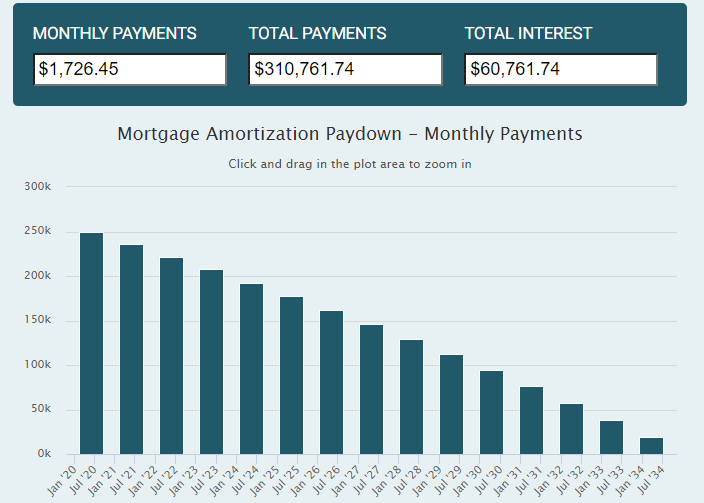

The shorter the amortization of the loan, the less total interest you will end up paying. For example compare the 30 year amortization graph above to the 15 year amortization scenario below. As you can see, the payment size increases but the total interest paid is reduced by more than half!

15 Year Mortgage

Calculations performed using the mortgage calculator at https://www.mortgagecalculator.net/cad/

Calculations performed using the mortgage calculator at https://www.mortgagecalculator.net/cad/

Home buyers and investors have to strike a balance between the payment size and total interest paid when choosing an amortization period. Most rental property investors choose very long amortization periods because it lets them increase the amount of monthly cash flow they can generate. Meanwhile many folks choose shorter amortizations when mortgaging their personal homes because they wish to eliminate the monthly expense as soon as possible. Both approaches have their merits and can make sense for some home buyers. Most people purchasing an investment property will opt for the longest amortization possible because it helps to maximize monthly cashflow.

Cash Back Mortgages

Some Canadian mortgage lenders offer lump sum payments that are paid out when the purchase completes. The amount is usually 1-7% of the total mortgage amount. Effectively they “pay” the borrower a big chunk of cash for giving them their business. The catch is that lenders only offer this feature on mortgage products that have higher than average interest rates. Interest rates on these contracts are usually at least 10 basis points (0.1%) above the going market interest rate on a 5 year term. Sometimes the rates offered are much than that. The lender does this so that they will earn enough extra money in interest charges over the term of the loan to more than compensate them for the cash payment they provide at the start of the loan. This means that borrowers are effectively agreeing to pay more overall in return for an upfront cash payment at the start of the loan. Cash back mortgages are always set up so that the lender will earn more overall than a comparable non-cash back mortgage. For this reason they are inadvisable in most circumstances. However the extra cost may be justified when purchasers use the cash to pay down higher interest debt, create a reserve fund and to invest in other products/ventures that will generate higher returns than the higher interest rate charged. It’s important to note that a cash back mortgage is different than an equity release (i.e. a cash out or reverse mortgage) type mortgage refinance. On the surface they may sound the same, but they are actually very different beasts!

Pros

- Lump sum cash payment provided when most purchasers need it most. Right after they have burned most of their savings on a down payment and now have moving expenses.

- The cash payment is tax free and can be used for any purpose.

- A great way to consolidate high interest consumer debt (ex. credit card debt).

- Can provide a reserve fund to cover moving expenses or renovations that need to be completed right away.

Cons

- The borrower always ends up paying more overall over the life of the loan.

- This feature is normally only included in fixed rate mortgage products.

- Harder to qualify for because of the higher interest rates.

- Higher mortgage fees

Purchase Plus Improvements

This type of mortgage product can be very useful for investors buying distressed properties and fist time home buyers that can only afford fixer uppers. A purchase plus improvements mortgage can be used to purchase a property and finance renovations immediately after the buyer takes possession. The catch is that the renovations must improve the value of the house, otherwise the mortgage lender would risk lending more than the total value of the property. The lender will make the usual transfer of funds to cover the initial purchase at the time of closing and a second transfer of funds to cover renovation costs after they receive proof that the agreed upon renos have been completed. The second payment amount is added to the mortgage principal and will accrue interest charges. To be approved you must show an official report/evaluation from a real estate appraiser that proves that the renovations in question will increase the value of the property by equal or greater to the total cost of said renos. This report must be supported by quotes from a certified contractor. Often the lender will require that the quote be from the contractor that will actually perform the work. There will also be a time limit, usually 60 or 90 days after the possession date, in which the renovations must be completed. Usually a second home appraisal or inspection is required to confirm for the lender that the renovations have been completed properly. The lender will then pay the contractor directly. The sum of the initial purchase price and renovation cost cannot exceed the maximum amount the borrower was pre-approved for. People typically use this type of mortgage when they don’t wish to use up all of their available cash savings right after buying a house. Some examples of the type of improvements that lenders will cover are listed below. You will need to be able to clearly show how any of the improvements will increase the property value before a lender will agree to this type of mortgage.

- Flooring

- Kitchen

- Bathroom

- Roof

- Plumbing

- Wiring

- Windows and Doors

- Improve energy efficiency

- Additions that increase the total floor space or the number of bedrooms

Pros

- Gives you the option of financing renovation costs instead of paying for them out of pocket.

- You have the chance to improve the value and/or function of your home or investment and enjoy the improvements right away.

Cons

- The purchaser will have to pay for multiple home inspections and appraisals.

- Organizing the quotes, appraisals, renovations, and inspections can be a logistical nightmare. These expenses are the buyer’s responsibility and need to be factored into the total mortgage cost.

- If the renovations go over budget the borrower will be responsible for paying the difference.

- The lender may refuse to advance funds if the renovations are not completed on schedule or to a minimum standard of quality.

An accredited mortgage broker is the best qualified person to seek specific mortgage advice from. This article is intended to explain the key pros and cons of some of the different types of mortgages available to Canadians. The goal of this article is to prepare the reader to ask the right questions and best evaluate their options in conjunction with advice from a mortgage finance specialist. Always consult with a certified mortgage finance professional before starting or ending a mortgage of any kind. Mortgage brokers and real estate lawyers are the best professionals to help ensure that your new loan is legally conforming, includes adequate mortgage insurance (for either you or the lender) and will not unnecessarily reduce your future home buying ability.

Connect with Dwell Logic

Consulting meetings are available via telephone, video conference (Google Meet or Zoom) or in person.

Get in touch with us to book a consultation.